Keynote Presentation

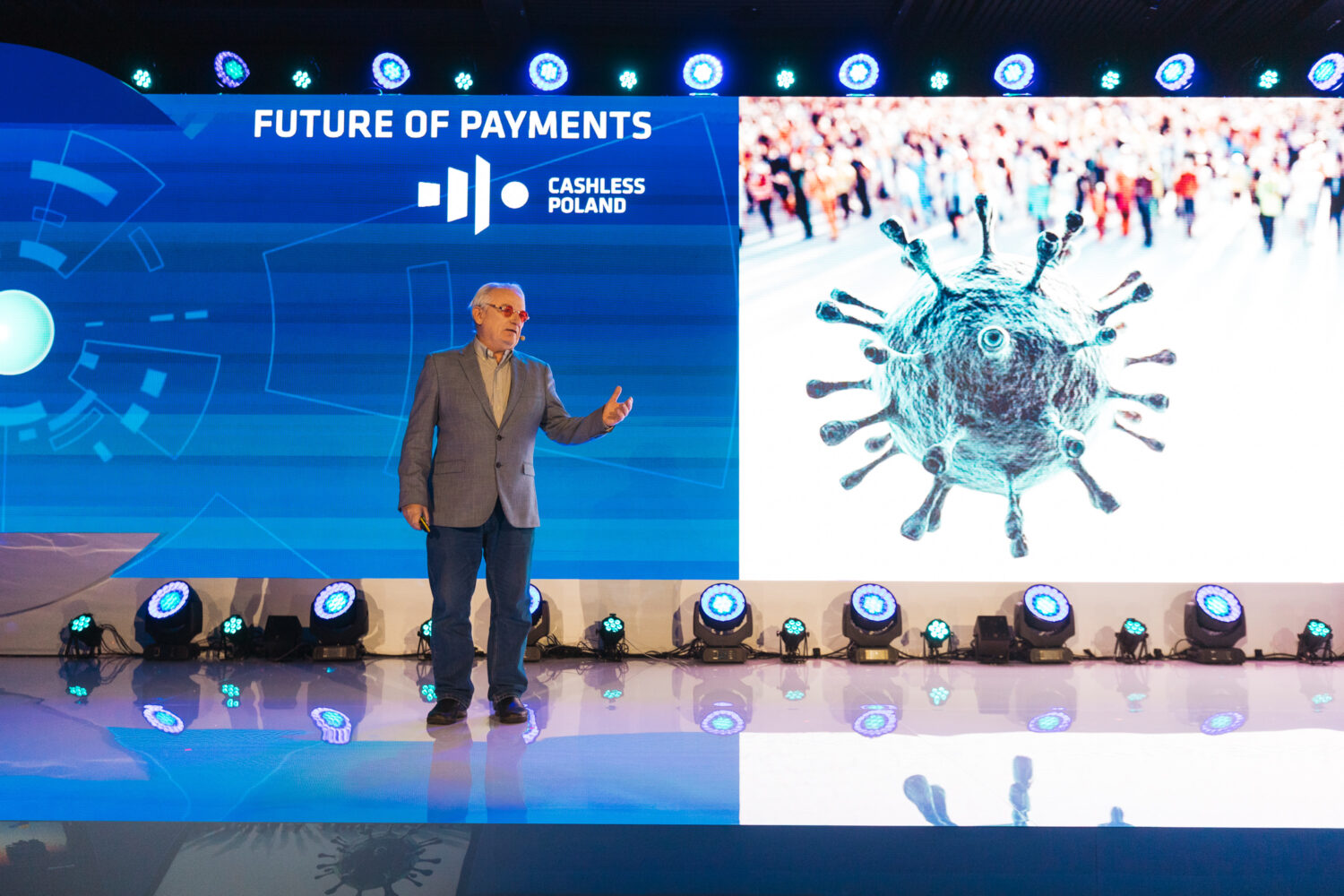

CHRIS SKINNER

PUBLIC SPEAKER

Bureau friendly downloads

Illustrative keynote presentation

titles include:

In the age of deep fake, what is real?

This presentation investigates how AI is changing our realities, and looks at what that means for all of us, and particularly our money. A critical question arises around

identity, authentication, verification and trust. How do you prove that you are you?

In a wide-ranging exploration of these themes, fintech gives some answers. What are they?

Intelligent Money: our future is where money thinks for us.

WHO cares about the money of the future? WHY should I care about the money of the future? These questions, and more, are addressed in depth in Intelligent Money. As money becomes digital, it will revolutionise everything. By 2030, digital money will make money personal, individualise currency and its usage, make it secure, enable it to grow automatically to meet our personal goals, manage risk automatically and make life simpler and easier for all. The most critical aspect of this book is HOW money will become intelligent, both digitally and artificially.

The bottom line is that money will soon be embedded, intelligent, invisible and everywhere. It’s a whole new world.

The decentralised smart companies of the future

Everything is becoming smart and connected, from our homes to our cars to our clothes. How does this change business, how we think and how we pay? If everything has GPT in its name, does that mean we have far less people working? If everything is decentralised, who regulates the system? How can you be artificially intelligent if you have dumb data?

This presentation looks at the key technologies coming downstream from artificial intelligence to artificial super intelligence, from cloud computing to quantum computing and from cryptocurrencies to central bank digital currencies. The big question it tries to answer is the role of centralised institutions in a decentralised world.

The past, present and future of banking, finance and technology

Finance has changed massively in the past years thanks to the rise of cloud computing and the mobile network. For the traditional institutions, this means a radical overhaul of the analogue business model. For the new firms of fintech, it has offered a massive opportunity to digitalise the industry. How will this all turn out? What is the future? How should a traditional firm invest and prioritise to be digital? How should a start-up work out their way to success? This presentation takes you through all the nuances of the past, present and future of banking, finance and technology, and how to navigate a way to winning.

Doing Digital – Lessons from Leaders

There are a small group of banks who are transforming to be digital banks. As we all know, this is incredibly difficult for a long-established bank with thousands of people and millions of customers. What are they doing right? How are they doing it? Why do we think they are digital banks? Is there a way we could all follow their path? Chris Skinner has been travelling the world for years, talking to banks that are doing digital. He selected five to be case studies – JP Morgan Chase, ING, BBVA, DBS and China Merchants Bank. From those interviews and discussions, Chris has found many lessons from banks that are doing digital right, and will share these lessons with the audience.

How banking and fintech improves society and the planet

This presentation looks at everything from how banking plays a role in the climate emergency through to the FinTech world using technology to overcome issues of inequality and inclusion. The themes include questioning the purpose of banking, and whether it is socially useful; how purpose can impact a bank’s role in the climate emergency; the way in which we can use finance to do good for society and the planet; the latest developments in cryptocurrencies; and more.

After the 2008 financial crisis, banks were described as being socially useless by the UK regulator. How is this changing? Amazingly, through FinTech and digital services, it is changing dramatically. There are now many movements across the network to use financial transactions to be good for society and good for the planet. What’s happening and who is driving this change? What does it mean for banks and what happens when you say you are green when, in fact, you are not? This presentation explores all of these themes in depth and demonstrates that digital transformation and green finance are actually coming together hand-in-hand.

How to Build a Digital Bank – Executive Workshop

Join Chris Skinner and global fintech leaders for an immersive, five-day workshop designed to help financial institutions envision, design, and launch a next-generation digital bank. Through interactive discussions, case studies, and hands-on planning, participants gain clarity on strategy, technology, regulation, profitability, and customer experience. Tailored to leadership teams and innovators, this programme delivers actionable roadmaps, proven insights, and lasting partnerships to future-proof your digital banking journey.