How to Build a Digital Bank Workshop

A comprehensive, world-class workshop for financial institutions and prospective clients aiming to design, build, and launch a next-generation digital bank.

5 DAYS · COHORT-BASED · ACTION-ORIENTED WORKSHOP

Get in touch to discuss your bespoke workshop program

Why This Programme?

This workshop goes far beyond theory. It’s designed to produce tangible outcomes for your institution:

- Strategic clarity on your digital banking vision and objectives

- Actionable business and technology model designs

- A bespoke launch roadmap aligned with your team

- Practical knowledge on profitability, risk, and talent management

- Long-lasting partnerships with leading fintech experts and regulators

Clients describe the experience as “conversations and fireside chats” rather than lectures. You’ll leave with clarity, confidence, and a plan.

What You’ll Learn

Across the five days, participants will explore every dimension of building a successful digital bank:

Foundations of Digital Banking – defining your strategic direction, business model, and value proposition.

Profitability & Monetisation – designing sustainable revenue streams and cost models.

Global Lessons – case studies from leaders such as Revolut and Atom Bank, with international comparisons.

Technology & AI Integration – creating scalable architectures and applying AI in customer service and fraud prevention.

Talent & Culture – building agile, high-performing teams and inclusive workplace cultures.

Regulatory & Risk Management – understanding licensing, governance, and compliance frameworks.

Financial Inclusion – expanding access to underserved communities with accessible, customer-centric products.

About the Workshop

This is not another lecture series. How to Build a Digital Bank is a highly interactive programme built around conversation, collaboration, and actionable outcomes. Over five intensive days, you’ll work alongside global experts to map your objectives, stress-test strategies, and design the architecture of your digital bank.

We combine deep expertise in digital transformation, AI innovation, regulatory planning, technology design, and customer-first product thinking. The result: a workshop that doesn’t just inspire, but arms you with tools, models, and a roadmap you can put into practice immediately.

Sample Agenda

While every programme is customized, a typical five-day agenda looks like this:

| Day 1 – Mapping objectives, keynote insights, and Revolut case study |

| Day 2 – Digital bank building and ecosystem deep dive |

| Day 3 – Best-in-class UX, fintech partnerships, and customer experience design |

| Day 4 – Values, regulation, technology drivers, and financial inclusion |

| Day 5 – Hands-on digital bank build, alignment, and roadmap delivery |

Who you’ll learn from

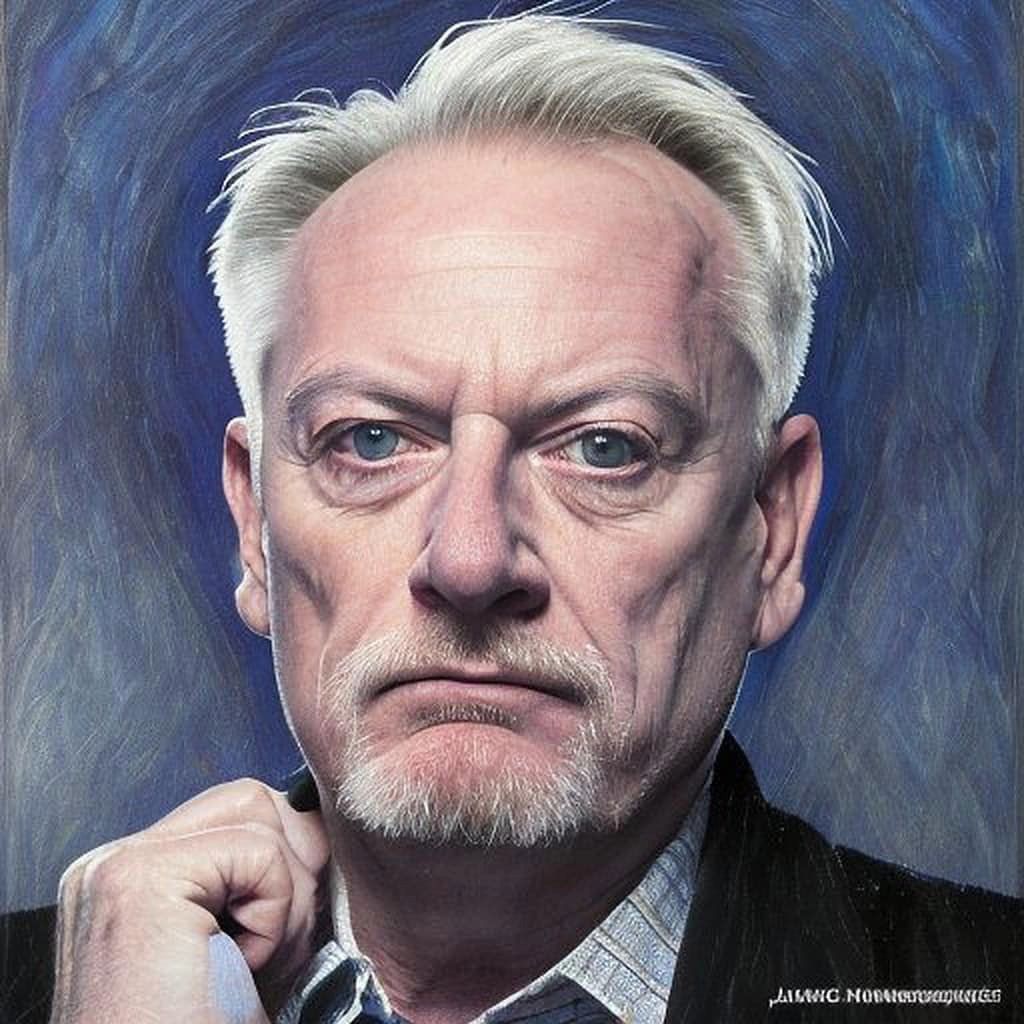

Learn directly from one of the most influential people in technology, who will share key methodologies, theories, process and tips that he has learned and used through his work experience.

Chief Executive Officer at the Finanser, Best Selling Author, Speaker and Keynote

Chris is Chief Executive Officer of the Finanser, a research and media firm focused on Fintech and the future of finance, a non-Executive Director at 11:FS, a best selling author, and regular commentator on BBC News, Sky News, CNBC and Bloomberg.

Chris is on the Advisory Boards of including B-Hive, Bankex, empowr, IoV42, Innovate Finance, Life.SREDA, Moven, Meniga, Pintail, Project Exscudo and the Token Fund.

He has presented alongside many leading world figures including Jack Dorsey, Hillary Clinton, Richard Branson, Meg Whitman, and Bill Gates.

Chris has worked closely with leading banks including HSBC, the Royal Bank of Scotland, Citibank and Société Générale.

Register to stay updated

Engage with us to schedule a discovery call. We’ll tailor the agenda to your goals and guide you through every step of your digital banking transformation.